E-COMMERCE FISCAL POLICY

EUROPEAN UNION AND ITALIAN VAT RULES FOR E-COMMERCE

ICDC is an Italian-based Company subject to EU and Italian VAT e-commerce fiscal laws and regulations.

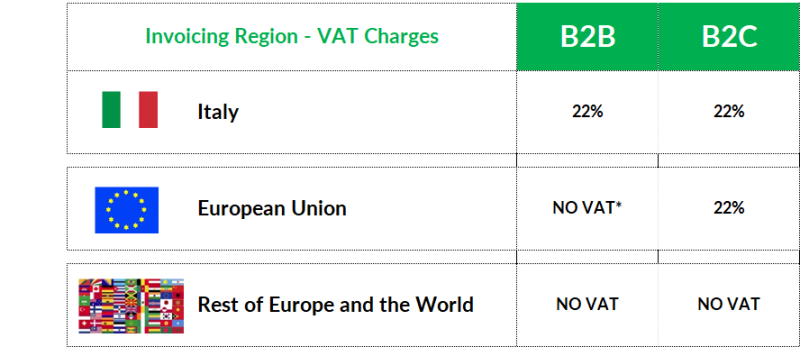

According to current rules, VAT charge is cleared from the invoicing at check-out according to the following summary table:

VAT, Italian IVA, does not apply to international sales and it is cancelled from shopping cart after order destination address entry.

For Italian and EU B2C (consumers) customers: Italian IVA charge applies at the rate of 22% to all our products.

Cross-border drop shipping option: delivery destination in EU and invoicing address out of EU requires Italian VAT to be paid in Italy and add to invoice.

*EU based companies: VIES check is automatically performed in our e-commerce by EU Commission approved software on VAT identification codes.